Digital euro - cash of tomorrow?

The digital euro (D€) is a concept that the European Central Bank (ECB) has been pursuing for the Eurosystem since 2020. The aim is to create a digital form of the euro that exists parallel to cash and existing electronic payment methods.

In recent years, the discussion about digital currencies has gained considerable momentum. While cryptocurrencies such as Bitcoin and Ethereum have attracted public attention, central banks around the world are working on their own digital currencies (Central Bank Digital Currency, CBDC) with significantly less public attention in order to take advantage of the benefits of digitalization while ensuring the stability and security of traditional currencies. The digital euro is one such initiative of the ECB. In our article, we examine how the digital euro works, the current state of development and the legal basis.

Reasons for the planned introduction of the digital euro

The motivation for introducing the digital euro can be summarized in three main objectives:

Reducing dependence on commercial non-European players

Ensuring economic stability

Creating added value for citizens and industry

The increasing digitization of the European economy and everyday life is leading to an intensified use of private and thus commercial digital means of payment. In order to continue to ensure that European citizens and companies have efficient and secure payment methods at their disposal and to be able to cope with technological progress and the resulting competition from private non-European players in a future-proof manner, a contemporary adaptation of the official forms of currency is necessary.

The decreasing importance of cash also endangers the balance between central bank money and private digital means of payment. This could weaken the role of central bank money compared to private, more agile alternatives and, as a result, the trust of the general population in the entire monetary system, including commercial bank money and ultimately also in the euro as legal tender, could be undermined in the medium term. However, economic stability and the smooth functionality of the financial system and payment transactions are highly dependent on strong trust in a stable and secure currency.

Private alternatives can be stablecoins from large technology companies, but also payment services such as Apple Pay, Google Pay or PayPal.

„Tech companies are usually closer to the customer and are so successful because they have been able to weave their offerings closely into people’s everyday lives. Integrating new payment services or even further financial services into these offerings could result in banks losing contact with customers. In the best case, banks would then only be service providers in the background, in the worst case, they would be largely obsolete.

Competition between banks and tech companies is certainly not a bad thing in itself. It becomes critical if the functioning of the financial system is impaired. In the interests of financial stability, we central banks are not the only ones who have a great interest in a functioning, successful financial system. A digital euro could offer people something that does not currently exist: a digital means of payment that is generally accepted throughout the euro area, whether for payments in shops, online or between people. Like cash, a digital euro would be fail-safe, easily accessible and, as a public good, basically free of charge.“

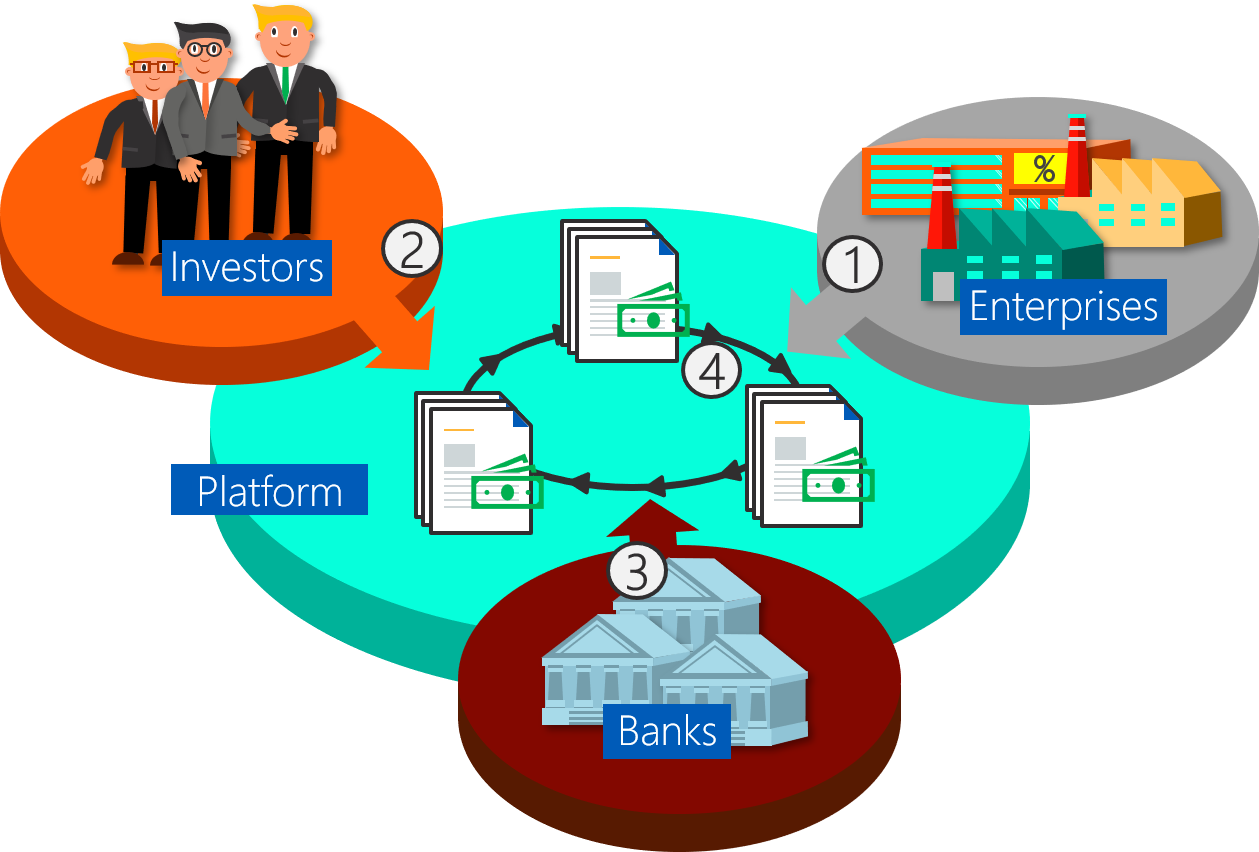

The digital euro is intended to be simpler, faster and more cost-effective in many respects, particularly in cross-border payments, and thus also strengthen the negotiating position of retailers vis-à-vis providers of payment solutions. Intermediaries such as banks have the special role of being the most important point of contact for retailers, companies and private individuals and of being responsible for all end-user services. The digital euro is also intended to serve as a platform for developing innovative and pan-European offers in electronic commerce and digital payments.

The D€ is intended to provide citizens with easy access to a digital payment method in order to promote financial inclusion. This is accompanied by high requirements for data protection and the cost-effectiveness of this means of payment. In order to ensure the expected data protection and the associated user rights, regulatory and legal frameworks must be expanded, in some cases newly developed, and a suitable technological infrastructure must be created that guarantees a high degree of security, reliability and availability, also with regard to cooperation with existing payment systems and service providers.

Many other countries are currently also examining the introduction of digital central bank money, in a total of 114 countries; however, some countries have already abandoned the concept because it was not well received by the population, including Denmark and Japan. However, at least German households are generally open to digital central bank money and there are also positive signals from the economy. From the perspective of the European Payments Initiative, however, there is still a need for clarification as to the extent to which the D€ offers advantages over real-time transfers and whether a public payment monopoly would not be created that would contradict an open market.

How the digital euro works

The digital euro is designed as a digital addition to cash and existing electronic payment methods. It is not a cryptocurrency in the traditional sense, as it would be fully controlled and regulated by the ECB. As things stand, it is supposed to work via a wallet, such as a smartphone or a card, which a private individual can set up with their bank, the ECB or possibly a public body. The wallet can be used to make analog cash, withdrawals and deposits in the digital euro, and the available balance can be used as a means of payment at any time and in real time at any location, online or offline. A correspondingly comfortable user experience through functionality that is available at all times would be essential for acceptance by society as a whole.

Technical basics

It has not yet been finally clarified which technology would be used if the D€ were introduced. It would be conceivable to use distributed ledger technology, but other decentralized and centralized systems are also still being examined.

Distributed Ledger Technology

A central element of the discussion about the digital euro is distributed ledger technology (DLT), which is also used in many cryptocurrencies. DLT makes it possible to manage and document transactions securely, transparently and decentrally. Instead of a general ledger managed by a central authority, there are any number of copies of the general ledger. Every transaction made is stored on all of these ledgers so that they are always synchronized. The fact that the transferred assets are recorded and confirmed in a decentralized manner through system-immanent processes leads to an acceleration of the transactions concerned.

Distributed Ledger Technology

The way in which the ledgers involved, or the computers managing them, achieve this synchronization differs greatly between specific implementations of DLT; for example, blockchains and directed acyclic graphs (DAG) are used. Blockchain technology, made famous by Bitcoin, is the best-known form of DLT.

Account model vs. token-based model

Two main approaches to implementing the digital euro are the account model and the token-based model. In the account model, users would hold accounts directly with the ECB, similar to traditional bank accounts. In the token-based model, on the other hand, digital euro tokens could be transferred directly between users, similar to cash. Both approaches can be used either in addition to DLT or as alternative methods. Let's take a closer look:

Account model

In the account model, the digital euro is managed in accounts similar to traditional money. Each user has a digital account managed by the central bank or an authorized institution. Transactions are realized by transferring money between these accounts. The account model can be implemented with both centralized databases and a decentralized DLT platform. In a decentralized implementation, several nodes could manage and update the ledger. In a DLT-based account model, consensus mechanisms such as Proof of Work (PoW), Proof of Stake (PoS) or others could be used to validate transactions and update the ledger.

One advantage of the account model would be that customers are familiar with the concept, which works similarly to traditional bank accounts, making it easier to accept and understand. Furthermore, this model would be comparatively easy to integrate into existing regulatory frameworks. Scalability, however, is a challenge: with large transaction volumes, managing many accounts could become complex and resource-intensive. The enforcement of the high level of protection of users' privacy would also have to be demonstrably ensured, especially in decentralized solutions.

Token-based model

In the token-based model, the digital euro would be treated as a digital unit (token) that can be transferred directly between users. Tokens represent the value and can be handled in a similar way to physical cash.

Such tokens could, if they are additionally implemented with DLT, be created and managed on a DLT platform. Each transaction would then be recorded in a distributed ledger. This would also make peer-to-peer transactions very straightforward: users could exchange tokens directly and without intermediaries, with the DLT securing and validating the transactions. Tokens can be exchanged easily and directly between users, which leads to a high level of user-friendliness. Furthermore, the aspect of scalability is easy to handle here: DLT can handle large volumes of microtransactions efficiently.

The challenge here is the aspect of security requirements. Tokens must be protected against counterfeiting and double-spending, i.e. the double use of the same token. This is particularly challenging for offline transactions. In addition, regulation and control would be more difficult than with the account model, for example with regard to money laundering and terrorist financing.

Regarding possible integration, it can be said that both models can be implemented on a DLT platform. DLT offers a secure, transparent and immutable basis for managing accounts and tokens.

If the account model is combined with DLT, the ledger would be kept on a DLT platform, with each node holding a copy of the accounts and their balances. Transactions would be validated by the DLT consensus mechanism and entered into the ledger.

If the token-based model is combined with DLT, tokens would be created and transferred on a DLT platform. Each transaction would be recorded in the ledger and also secured by the DLT consensus mechanisms.

Hybrid models

It is also possible to develop hybrid approaches that combine elements of both models. For example, tokens could be embedded in an account system so that users can use accounts for larger transactions as well as tokens for smaller, everyday payments.

The regulatory and legal framework will also be decisive for the choice of the specific technology.

Waterfall approach

One technical concept should be implemented in any case, the waterfall principle:

If the upper limit is exceeded in a transaction, the difference would automatically be posted to a linked bank account, provided such a link exists. In the same way, similar to PayPal, this bank account would be accessed if the amount in the wallet was not sufficient for a payment (reverse waterfall).

In general, the D€ should correspond to the latest technological potential when it is introduced to make follow-on innovations attractive and to ensure acceptance by all those involved.

Legal situation

The legal framework for the digital euro has yet to be defined.

The development of such a legal framework is essential, as special properties are being discussed for the digital euro that only state money can have. Similar to cash, the digital euro should be considered legal tender. A general obligation to accept it with only a few exceptions should also be one of the special features. Specifically, Article 9 (a) of the proposal for a regulation of the European Parliament and of the Council on the establishment of the digital euro [1] states that a business is obliged to accept the digital euro unless it accepts any other digital means of payment or employs at least ten people and has a turnover of more than two million euros per year.

No less important is the balance of interests between the parties involved: As public money, the digital euro should be largely free of charge for citizens. However, intermediaries such as banks, which would be responsible for distribution to end customers in a similar way to cash, must also be able to generate income in order to be able to cover ongoing costs by providing and maintaining the technical infrastructure. A legal framework is needed here to protect traders who are forced to accept from unfair fee structures by intermediaries.

The planned holding limit, which is intended to prevent substantial deposit outflows in the banking industry and thus ensure financial stability, also needs to be discussed legally. On the one hand, the amount, and on the other hand, the question of who should be able to define it and, if necessary, adjust it, using which procedure.

The possibility that a token structure could be used for the D€ instead of an account logic would also break new legal ground and it would have to be examined how technology and law fit together and whether the legal framework would need to be adjusted.

The basis of the legislative process is the Treaty on the Functioning of the European Union, Article 133 [2], and the proposal for a regulation of the European Parliament and of the Council on the establishment of the digital euro.

Development and Outlook

In March 2021, the European heads of government spoke out at a Euro summit in favor of pushing for a "stronger and more innovative digital finance sector and more efficient and resilient payment systems." To this end, the explorations into the possible establishment of a digital euro should be pushed forward.

In July 2021, it was decided that an investigation phase for the D€ should start and last two years, which finally began in October 2021. The importance of the availability of central bank money in the digital age and the robustness of digital money against illegal activities and financial instability were emphasized. The focus of the investigations is the concrete functional design of a risk-free, available and digital form of central bank money. Important factors here were data protection, combating money laundering, offline access for users and inclusion of as large a part of the population as possible. On the technical side, the Eurosystem's TARGET Instant Payment Settlement (TIPS) and blockchain were tested in a practical trial, particularly with regard to scalability, possible offline use and possible circulation restrictions, with satisfactory results. This trial was launched in September 2020.

Between September 2022 and July 2023, the European Central Bank published four progress reports on the digital euro, highlighting the progress made in its investigation phase. These reports have already defined some goals that should be enshrined in law in the future. In order not to establish the D€ as a form of investment, quantitative limits for individual accounts are required. It should maintain the role of public money as an anchor of the payment system in the digital era and contribute to Europe's strategic autonomy by offering a European payment method. The role of intermediaries, who would be direct contacts for merchants, companies and private individuals and would have to fulfill the tasks of user and transaction management, is also highlighted. Supervised intermediaries would continue to be responsible for all roles in the digital euro ecosystem that affect the end user, in particular for a user-friendly and inclusive design.

The preparation phase has been running since November 2023, during which comprehensive analyses, investigations and tests are being carried out to monitor the compatibility of various implementation scenarios with the high requirements of quality, security and inclusivity. This phase is expected to last until October 2025.

The digital euro should in principle be available to private individuals, public bodies and companies that are or were once established at least temporarily in a euro area member state. A concrete rule proposal can be found in [1].

Data protection challenge

The digital euro could not function exclusively offline and anonymously, which is what distinguishes it from cash. Topping up your own balance requires internet access or an ATM. However, the possibility of an offline transaction between private individuals or in physical stores makes it quite robust against a lack of network coverage, power outages or the interception of user data.

In general, online payments should also be implemented in such a way that the Eurosystem, as the issuer and provider of the payment infrastructure, cannot directly link transactions to specific people. Possible techniques for this are hashing, encryption or simply pseudonymization.

Intermediaries would, however, have access to online transaction data for the digital euro to the extent that this would be necessary to comply with EU law, for example in the sense of combating money laundering. Complete anonymity would therefore not be possible. This difference to existing cash, combined with the possible fragility of the wallet, has also provoked some significant criticism. There is also a huge amount of criticism on the internet, which even portrays the introduction of the digital euro as a step towards total surveillance.

One possible approach to making offline payments truly untraceable would be to use zero-knowledge proofs, a question-and-answer protocol between the parties involved that makes it possible to prove a statement without disclosing information about that statement, for example, to verify that there is authorization for a transaction without disclosing information about its details. Data protection advocates have criticized the fact that such techniques are not used and that a personal wallet is to be introduced in general. However, the ECB promises an extremely high level of data protection and that intermediaries would only have access to personal data within the framework of compliance with Union law.

„In the case of offline payments, the personal transaction data would only be known to the person paying and the person receiving the payment and would not be passed on to payment service providers, the Eurosystem or supporting service providers.“

Finbridge as your partner in payment transactions

We are following the development of the digital euro with great interest. When introduced, the (financial) market will face a major challenge in implementing the digital euro as an attractive and competitive means of payment. We will keep you informed about the development of the digital euro and challenges in payment transactions in general.

Thanks to our comprehensive knowledge in the area of payment transactions and coupled with our technical and methodological expertise, we at Finbridge can respond flexibly to your specifics, needs and wishes and support you with your payment transaction challenges.

Author: Daniel Kramer

Sources

[2] European Union. Treaty on the Functioning of the European Union

[4] Members of the Euro Summit, 25/03/21. Statement by the members of the euro summit

[5] ECB press release, 14/07/21. Eurosystem launches digital euro project

[6] EZB, Juli 2021. Digital euro experimentation scope and key learnings

[7] European Commission. A digital euro fot the EU

[8] EZB, 29. September 2022. Progress on the investigation phase of a digital euro

[9] EZB, 21. Dezember 2022. Progress on the investigation phase of a digital euro – second report

[10] EZB, 23. April 2023. Progress on the investigation phase of a digital euro – third report

[11] EZB, 13. Juli 2023. Progress on the investigation phase of a digital euro – fourth report

[13] ECB. Towards a digital euro

[15] European Payments Initiative. Stellungnahme von EPI zum Digitalen Euro (german)

[17] ECB. Digital euro and privacy

[19] ECB. FAQs on a digital euro

[20] Article by Maarten G.A. Daman for the ECB Blog, 13/06/24. Making the digital euro truly private

![Hedge Accounting [Part 2]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1592205162143-L919DBQ2UQF59D4R9WFH/jeff-fan-29ebQh7e78M-unsplash.jpg)

![Hedge Accounting [Part 1]: Prospective Testing and the Risk Induced Fair Value](https://images.squarespace-cdn.com/content/v1/54f9ea6be4b0251d5319ad8b/1591683719107-BDZ43MTDO65RH9XKXBG6/christopher-burns-FUh6nK3s0po-unsplash.jpg)