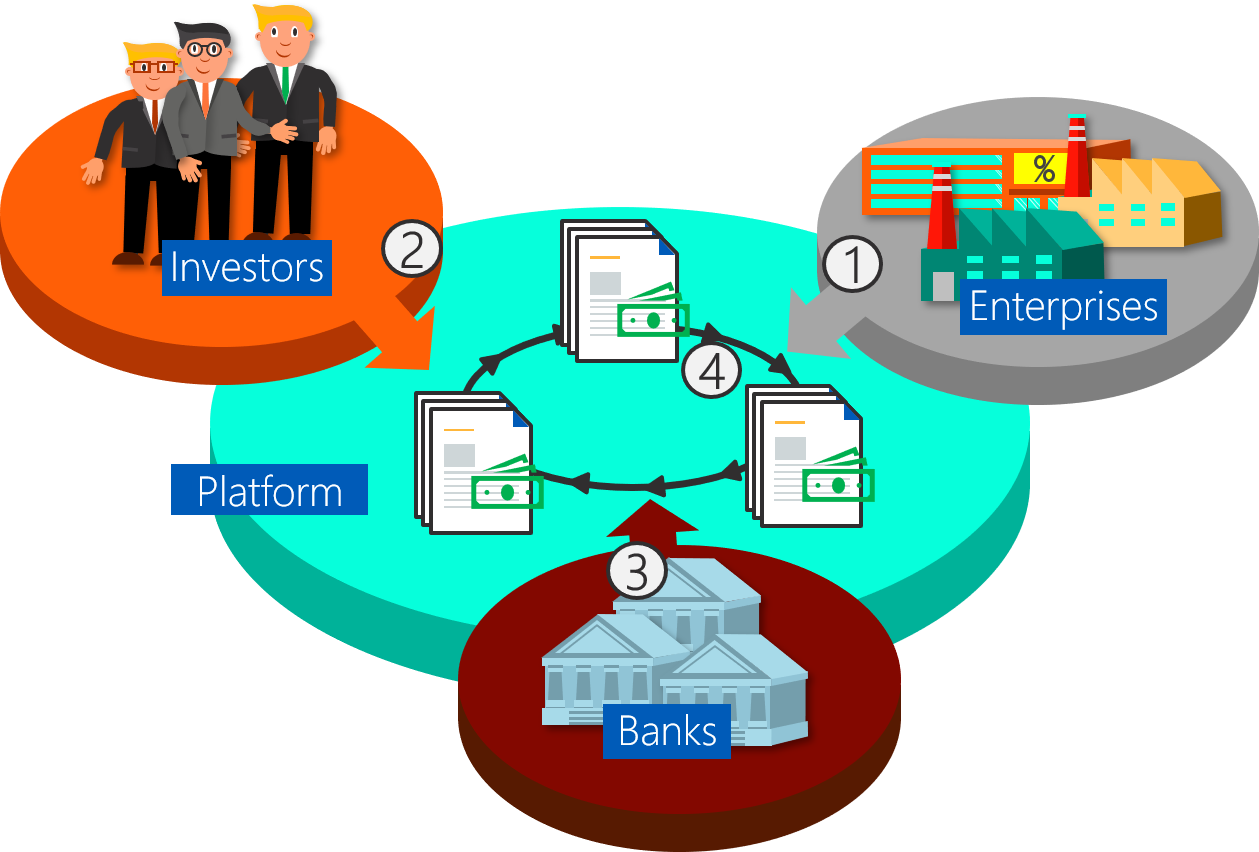

The Schuldschein market has seen an unseen spring of digital platforms, offering a digitized Schuldschein process, and supporting the boost of the Schuldschein in terms of transaction volume and deal numbers. The traditional process bears several inefficiencies that can easily tackled by shifting the process onto a digital platform. A platform can enhance standardization, transparency and processing time significantly. This article provides a current view on the platform evolution in the Schuldschein market.

WeiterlesenFrom being a traditional niche product, the Schuldschein has evolved to being a serious alternative for other financing products: The traditional deed-based instrument, Germany-based and once owning a rather sedate and dusty reputation, now also attracts growing interest in international markets. With lower documentation requirements than a bond, higher transaction volumes than a loan, combined with a high level of standardization, the Schuldschein more and more stands out as a save and appealing way to invest and an uncomplicated way for companies to acquire external financing.

WeiterlesenManagers of every level refer to the one or the other BI method to master the challenges of their daily work life and also the business departments employ BI techniques to get most out of their data. However, only few make use of the plethora of powerful self-service BI tools (SSBI tools) available on the market.

Thus, this article elaborates on the potential of BI in general and SSBI tools in particular. We summarize pros and cons and compare these to the well-known and very individual MS Excel & Access dashboard solutions.

WeiterlesenOpen Banking or API Banking - the opening of the traditional banking sector to third-party companies – has become a major topic in finance. It’s not only the new Payment Services Directive (PSD2) of the EU, affecting all banks located in the EU, that leads to an energized, pioneering atmosphere. More and more IT-driven developments result in banks having to deal with the question of how to position themselves in a future market with not only plenty of new business opportunities, but also numerous new competitors on the rise. Open Banking is certainly strongly transforming the financial sector. It challenges the traditional structures and has the potential to revolutionize the entire industry.

WeiterlesenIn financial industry, there’s hardly any topic that is being discussed more controversially than the PSD2, the "Payment Services Directive 2" of the EU. The directive entered into force on September 14, after a year and a half of preparation time. The new directive requires all banks in the EU to revise their security concepts and communication interfaces. This confronts institutions with the issue of an opening up of the industry to third-party providers and, in a broader context, the digitization and restructuring of the financial world.

PSD2 is the driving force of the concept of open banking in Europe and it is also shifting paradigms internationally.

WeiterlesenIn the world of established business processes, Robotic Process Automation (RPA), or short Robotics, is on everyone’s lips. As a tool to automate well-defined but time-consuming repetitive standard processes in a cost-effective way, RPA has versatile applications.

WeiterlesenIn 2017, the British Financial Conduct Authority (FCA) announced that the calculation of the LIBORs will not be continued after 2021. It is to be replaced with a new risk-free reference interest rate. All the main currencies will be affected. We describe the possible impacts as well as the necessary changes that are required during the conversion to the new interest rate.

Weiterlesen